The smartphone industry faces an unprecedented challenge heading into 2026: a severe shortage of DRAM and LPDDR memory driven by the explosive demand for AI servers. This crisis forces manufacturers to make tough choices—raise prices significantly or downgrade specifications, potentially reversing years of progress in RAM capacity and performance.

What started as surging PC RAM prices has now spilled over into smartphones. Reports from TrendForce, Counterpoint Research, and industry insiders paint a grim picture: memory costs could rise another 20-30% in Q1 2026, pushing average phone prices higher while base RAM configs drop. Low-end models may revert to 4GB, mid-range to 8GB max, and even flagships could ditch 16GB options. Is this the end of the “more RAM is better” era? We explore the causes, impacts, and what it means for consumers.

The Root Cause: AI Servers Gobbling Up Memory Supply

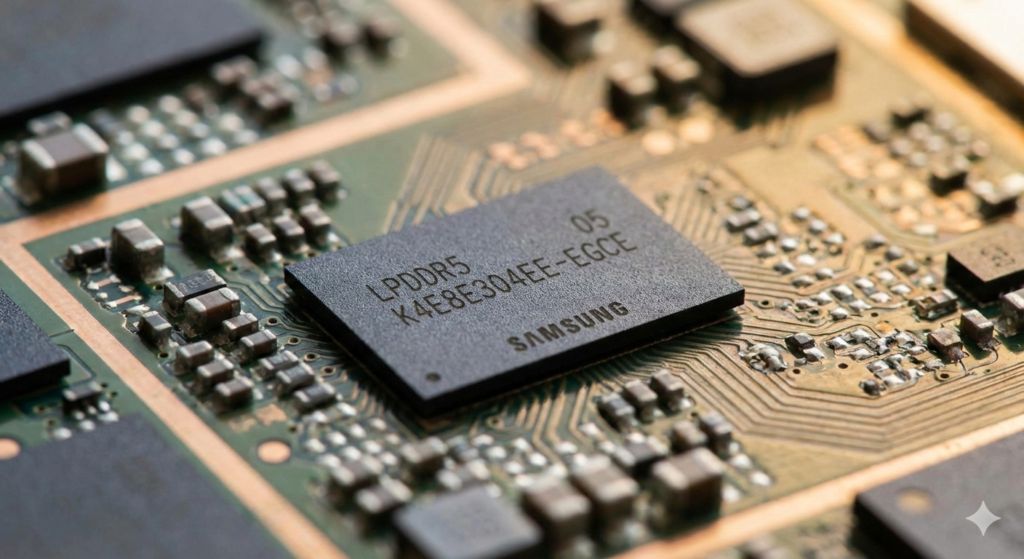

The culprit? High-Bandwidth Memory (HBM) for AI accelerators like Nvidia’s Blackwell GPUs. HBM is far more profitable than consumer LPDDR5X (smartphone RAM), so giants Samsung, SK Hynix, and Micron prioritize it—diverting wafers and production lines from mobile memory.

Key facts fueling the shortage:

- AI demand grows 35% in 2026 vs. 23% supply growth (Reuters/Counterpoint).

- Nvidia alone consumes LPDDR5X volumes rivaling major phone makers.

- Prices already up 50% YoY in 2025; another 20-30% hike expected early 2026.

- Shortages persist until 2027-2028, per TeamGroup and TrendForce.

Result? Smartphone BOM (bill of materials) costs rise 8-10%, hitting low/mid-range hardest.

Impact on 2026 Smartphones: Downgrades and Price Hikes Incoming

Analysts predict manufacturers will respond by:

- Reducing RAM configs: 16GB variants “nearly disappear”; 12GB models down 40-50%; base shifts to 6-8GB (mid-range) or 4GB (budget).

- Raising prices: Flagships +10-20%; mid-range +$50-100; overall ASP (average selling price) to $465 (up from $457).

- Delaying launches: Focus on profitable high-end models.

Examples:

- Xiaomi already trimming RAM on some 2026 lines.

- Samsung eyeing Galaxy A-series hikes.

- Low-end phones returning to 4GB RAM—last common in 2020-2021.

On-device AI (e.g., Gemini, Apple Intelligence) needs more RAM for models/apps. Downgrades could mean aggressive background killing, slower AI features, or app reloads—ironic as AI drives the shortage.

| Segment | 2025 Typical Base RAM | Projected 2026 Base RAM | Price Impact |

|---|---|---|---|

| Budget (<$300) | 6-8GB | 4-6GB | +10-20% |

| Mid-Range ($300-600) | 8-12GB | 6-8GB | +15-30% |

| Flagship ($700+) | 12-16GB | 8-12GB (16GB rare) | +10-15% |

Why Manufacturers Are “Abandoning” Consumers

Samsung, SK Hynix, and Micron control 93% of DRAM. They chase AI margins:

- HBM yields 4x premium over DDR5/LPDDR.

- No major consumer fab expansions until 2027+.

- Short-term contracts lock high prices.

Consumers lose as lines shift to enterprise. Xiaomi’s president: Secured 2026 supply, but warns of hikes. Framework (PC maker): Called it a “seismic shift.”

LPDDR6: Hope on the Horizon?

JEDEC finalized LPDDR6 in July 2025—faster, more efficient for AI/mobile. But mass adoption? Flagships only in late 2026 due to costs. Mid-range sticks with LPDDR5X longer, exacerbating shortages.

What This Means for You in 2026

- Buy now? If needing a phone soon, 2025 models (e.g., Xiaomi 17, OnePlus 15) offer peak RAM/value before cuts.

- Wait? Prices stabilize post-2027, but 2026 could be “worse yet more expensive” year.

- Bright side? Optimized software (Android 16+) may mitigate lower RAM; microSD returns for storage.

Verdict: A Temporary Reversal, But Painful for Consumers

The RAM crisis isn’t permanent—new fabs by 2027-2028 will ease it—but 2026 looks bleak: fewer high-RAM options, higher prices, potential spec regressions. AI advances servers at consumer expense, highlighting supply chain fragility.

Manufacturers aren’t “abandoning” us maliciously—they follow profits. But the result? Stagnation in mobile progress while AI booms.

If planning a 2026 upgrade, brace for compromises—or stock up on 2025 deals. The “more is better” RAM race pauses; efficiency takes center stage. Thoughts on this rollback—fair trade-off for AI, or consumer betrayal? Share below!